Global insured losses from floods totaled $80 billion from 2011 through 2020.* They topped $40 billion in just the last 24 months.

If population growth and urbanization have traditionally been the drivers of flood losses, climate change has officially taken the wheel. According to Swiss RE,* insured losses from flooding totaled $80 billion worldwide during the decade from 2011 through 2020. But they exceeded $40 billion in 2021 and 2022 alone. As global temperatures continue to rise, the cycle of precipitation and evaporation is accelerating—pumping more warm moisture into the air and fueling extreme weather events. Within the next five years, there’s a 50-50 chance average global temperatures will reach the point at which the risk of extreme weather events will rise dramatically. If 2022’s flooding in Australia, France, the United States, and Pakistan are any indication, the human and economic toll could be harrowing.

While the insurance gap for flood remains daunting, better datasets and modern risk modeling represent enormous opportunity for underwriters. But more urgently, they can boost efficiencies and reduce costs associated with flood-related CAT response. Just look at ICEYE, a member of Guidewire’s Insurtech Vanguards incubator program and winner of our 2022 Pitch Day competition. When integrated with Guidewire, ICEYE’s satellite-based flood monitoring solution can provide insurers with near real-time visibility into areas impacted by a flood so they can prioritize response efforts as never before possible.

Who?

ICEYE owns and operates the world’s largest constellation of synthetic-aperture radar (SAR) satellites to provide insurers with near real-time situational awareness of floods to enable objective, data-driven decisions during storm events. Unlike conventional optical satellite imagery, ICEYE’s unique technology allows its satellites to capture and relay high-resolution images of any area on Earth—in daylight, at night, and even through smoke, clouds, or rain. When integrated with Guidewire ClaimCenter, ICEYE’s SAR-enabled Flood Insights solution can provide reliable and consistent flood hazard data before, during, and after a flood event. This includes flood depth, extent, and duration within hours of a given flood peak. Armed with this intel, insurers would gain the ability to calculate exposure and proactively carry out CAT response to best serve policyholders in a time of incredible stress.

What is the value proposition?

Truly effective change detection requires persistent monitoring. ICEYE’s constellation of radar satellites unlocks access to new and valuable flood hazard data on any location on Earth—no matter the time of day or atmospheric conditions. As the world experiences heavier rainfall, fiercer storms, overflowing rivers, and flash flooding in areas that aren’t generally near large bodies of water, ICEYE’s observation data has many benefits to insurers and the people they serve.

Augmented with data from HazardHub and other sources, for instance, ICEYE’s SAR-based insights could help close the flood insurance gap. Nearly half of the U.S. population lives in coastal counties or floodplains that will only grow more vulnerable to rising flood risk—yet only 18% of flood damage is currently covered. Through the ability to understand and price risk accurately, these and other rich data sources integrated to the Guidewire platform could enable insurers to cover otherwise uninsurable properties, create compelling new parametric offerings, and expand into untapped markets.

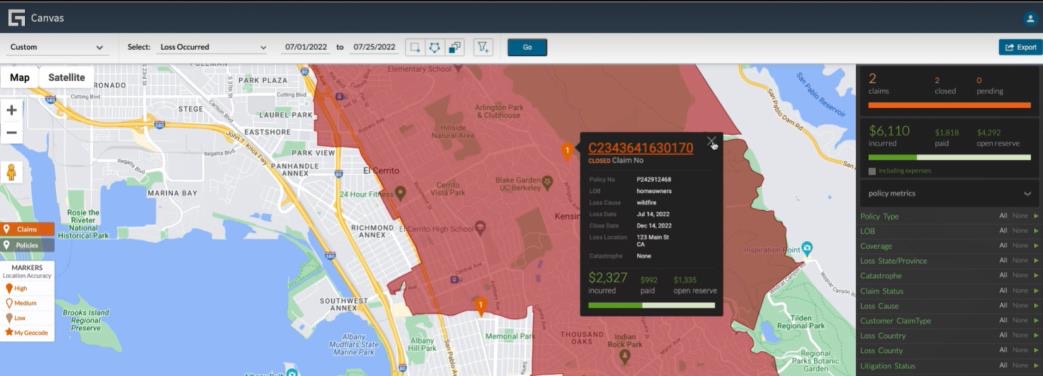

And just imagine this technology integrated to ClaimCenter and Guidewire Canvas claims analytics application. By gaining high-fidelity visibility into current conditions in areas hit by flood, Guidewire customers can quickly size damage, scale response, and streamline the claims process faster and more cost-effectively than ever before.

Within Canvas, claims teams can zoom in on individual properties, understand the depth of water, and calculate their financial exposure from it and every other covered property within the flood zone. And within ClaimCenter, they can automatically create claim files for each of these properties—there’s no need to wait for an insured to report a loss. ClaimCenter can proactively assign adjusters to adjudicate the damage for faster and better servicing.

With data from ICEYE, claims teams can also direct field adjusters and vendors to the hardest-hit areas first. And post-event, they can identify possibly miscategorized claims to maximize reinsurance recovery efforts. Rules within Guidewire will also alert adjusters to potentially fraudulent claims that fall outside the geographic area impacted by the flood and date of loss—reducing the number of undetected fraud incidents amid mass claims-processing efforts.

What is the opportunity?

When integrated to Guidewire, ICEYE’s satellite-based Flood Insights solution gives P&C insurers a previously unattainable level of situational awareness before, during, and after large-scale flood events. With near-real-time visibility into conditions, insurers can:

- Deliver faster, better service through automated claim creation and processing

- Leverage near-real-time data to triage response efforts based on priority

- Enhance the claims experience by putting flood victims on the path to recovery faster

- Boost retention with a remarkable level of service customers will never forget

Want more detail?

Watch this video to learn more.