Covid-19 is forcing our industry to rethink how insurers do business with their customers. In this blog series, I will focus on insurtechs in our partner community that are enabling the “new normal” of digital and online business.

August 2020 Update

On August 5, 2020, One Inc announced the company has acquired Invenger, including its digital claims payment product, Invenger-InsurPay. Both companies are Guidewire PartnerConnect Solution partners, and while the One Inc Digital Payments Platform includes inbound premiums and outbound claims payment functionality, Invenger-InsurPay focuses solely on digital claims disbursements. The two insurtechs will combine their product lines, services, and resources, leveraging key areas of synergy between their platforms to provide a robust, feature-rich digital payments solution for the insurance industry.

Digital Payments Increase 15% YoY

Governments and regulatory bodies are discouraging the use of cash and checks during the Coronavirus outbreak because they can act as potential carriers of the virus. As a result, the adoption of digital payments is increasing at a rapid pace of 15% year-over-year. Digital transactions are free from any contact or physical interaction. They also provide a faster and more secure way to pay and receive money. Our PartnerConnect Solution partner InsurPay, like Guidewire, serves one industry: Property & Casualty insurance. They have a laser focus on replacing checks through digital payments. Integrated to Guidewire, insurers can get funds into the hands of claimants and policyholders, quickly and safely.

Who?

InsurPay provides a digital insurance payment platform, which helps insurance companies leverage modern financial technologies to make electronic payments easier and more convenient for paying customers, vendors, lienholders, and claimants.

What is the value proposition?

Insurers can take advantage of the InsurPay accelerators in the Guidewire Marketplace to seamlessly integrate the InsurPay digital payments solution to Guidewire and replace checks for both inbound premium payments and outbound claim disbursements. InsurPay’s accelerators for PolicyCenter, ClaimCenter, and BillingCenter facilitate the integration with our solutions and are expected to reduce implementation effort by 75% or more when compared to a custom integration.

In this short blog, I will focus on the ClaimCenter integration as it is the most mature (it is on ClaimCenter version 10) and is the most widely used by our customers.

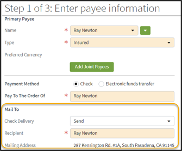

Creating a check within ClaimCenter is quick and easy because we prefill the check with relevant data like payee and mailing address. Hopefully, the customer wants their check printed because that is the out-of-the-box option we provide.

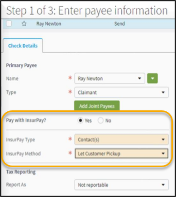

We know customers want payment method options. Methods not offered as standard with ClaimCenter, include customer pickup, direct deposit, and debit card. Integrated to InsurPay, the payment screen within ClaimCenter is extended to include a “Pay with InsurPay” radio button which expands payment methods to include the methods described above among others.

This integration is designed to give ClaimCenter users the ability to create payments using the familiar Check Wizard in ClaimCenter. The InsurPay payments are treated as checks within ClaimCenter, and take advantage of all the standard ClaimCenter features associated with checks, including permissions, approvals, authority limits, and reserve accounting.

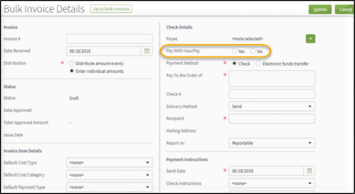

And InsurPay payment methods can also be leveraged with our bulk invoicing functionality

What is the opportunity?

Field adjusters are no longer restricted to creating physical drafts when in the field. With InsurPay integrated to ClaimCenter, they can create electronic payments.

Printng and mailing checks is expensive. Insurers using the InsurPay digital payments platform can achieve an 80% savings on check printing costs according to InsurPay and they can better serve the evolving needs of their customers.

Want more detail?

Click on the case study from The General. Spoiler alert! By moving claim payments to the InsurPay solution integrated to ClaimCenter, The General estimates a savings of more than $1 million annually in processing time and speed!

Watch our webinar with InsurPay – Virtualization of Claims Payments on May 13. Register here.