Amid rising competition, economic uncertainty, and soaring customer expectations for speed and convenience, digital payments capabilities have emerged as more than just a better way for P&C insurers to collect premiums, disburse claims, and reconcile transactions. They’re quickly becoming a competitive opportunity for carriers seeking to boost customer satisfaction and retention, cut costs, and enable next-gen operating models.

As the world has grown steadily more digital over the past decade, the ability to make and receive payments through mobile and online channels has become an essential element of modern-day business. According to McKinsey, nearly nine in ten US consumers now routinely use one or more digital payment methods, with penetration for digital payments hitting 89% in 2022. Worldwide, digital payment transactions are projected to reach $9.68 trillion this year—and could top $20 trillion by 2026.

Today, these payments can be made through online card-not-present (CNP) or contactless transactions, brand and retailer mobile apps, wallets like Apple Pay and PayPal, peer-to-peer payment apps like Zelle or Venmo, embedded Buy Now Pay Later (BNPL) financing offerings, automated clearing house (ACH) transactions, and more. As much as 57% of all consumers now choose to do business with companies based in part on the digital payment options offered.

Yet while most industries have made the technological investments needed to meet this demand, paper checks continue to comprise a significant portion of transactions in the P&C sector. In my view, this is a massive opportunity. Here’s why.

From Basic Transaction to Strategic Differentiator

In an industry that is quite literally built around financial transactions, payments are no longer incidental to the customer experience. They’re intrinsic to it.

Today, 85% of consumers prefer digital payment options when transacting, and 95% rate speed of settlement as the top factor for satisfaction. Meanwhile, the consumer segments most familiar with paper checks aren’t growing any younger. According to a recent survey from NerdWallet, many Millennial (ages 28-43) and Gen Z (ages 12-27) consumers don’t use checks. So far at least, half of all Gen Zers have never written one—and may never do so.

This is no small matter. Longer claim cycle times and complicated digital experiences are leading to lower customer satisfaction scores, according to J.D. Power’s latest auto and property claims surveys. What’s more, industry reports indicate average churn per customer jumped 5%—costing carriers $540 million in lost revenue—in the two years before the mass consumer shift to digital channels during the pandemic.

Modern digital payments capabilities can create an opportunity to transform the claims experience while generating whole new efficiencies—and competitive advantages—for carriers in a number of ways, including the following:

Simplified Premium Payments

Premium payments represent the single most frequent interaction policyholders have with insurers. For all the reasons I’ve mentioned, being able to easily make payments could increasingly become a must-have for digitally savvy consumers. In response, a growing number of other insurers are beginning to offer options for CNP transactions, mobile wallet payments, pay-by-text and more. This flexibility and convenience can help insurers attract and retain more customers.

Instant Claims Disbursement

According to a recent survey from Mastercard and VPay, 60% of consumers report receiving their last claim payment by check, with 50% having to wait three or more days to access the money. So it’s no surprise that more than half say they’d be willing to switch insurers to get access to instant digital claims payments deposited to their bank accounts or through “push-to-debit” transactions directly to card or payment apps.

Streamlined Operations Cost Savings

Today, payments processing accounts for up to 28.5% of operating costs for P&C insurers. But processing and mailing checks can cost 70x more than a digital payment. Whether inbound or outbound, digital payments can help carriers reduce administrative costs, including check processing, mailing, and storage. And because payments are instant, they can improve cash flow by receiving premiums and making claims payouts faster while improving reconciliation, reporting, and compliance operations.

Accelerated Product Innovation

Major industry trends such as the growing importance of embedded insurance and other alternative forms of distribution are predicated on digital payments. As technologies like blockchain, AI, and machine learning improve the accuracy, speed, and security of digital payments, insurers will be able to offer more personalized payment options and services. They’ll also be able to integrate digital payments with other technologies, such as Internet of Things (IoT) devices and chatbots, creating seamless—and even “invisible“—payment experiences.

Mastering the Digital Payments Future, Today

The possibilities enabled by digital payments are as compelling as they are urgent. As a growing number of P&C insurers replace legacy systems with flexible, cloud-based platforms, it’s reasonable to expect that by 2030, those fastest to capitalize on digital payments will gain significant share over rivals. So how can carriers position themselves for success?

First, you must embrace a customer-centric mindset across the payments value chain and align technology and strategy accordingly.

The ability to quickly meet growing demand for new and existing digital payment models requires an enterprise-class payment solution that’s fully integrated to the insurer’s cloud platform across billing and premium and claims payments operations. Without that, you risk replacing one disjointed system with another.

To this end, Guidewire teamed up with longtime payments processing partner One, Inc., to develop the Guidewire Digital Payments Solution. This prebuilt, standardized integration enables carriers to quickly and cost-effectively launch new payments capabilities throughout the policy, claims, and billing lifecycle.

As a payments processing provider, One, Inc., is uniquely focused on the insurance industry and is a Premier Guidewire Partner with over 65 joint deployments. The Guidewire Digital Payments Solution is designed to maximize our combined industry expertise to enable rapid deployment of digital payments for both InsuranceSuite Cloud and InsuranceNow.

Understand that digital payment strategies aren’t just about receiving and disbursing funds.

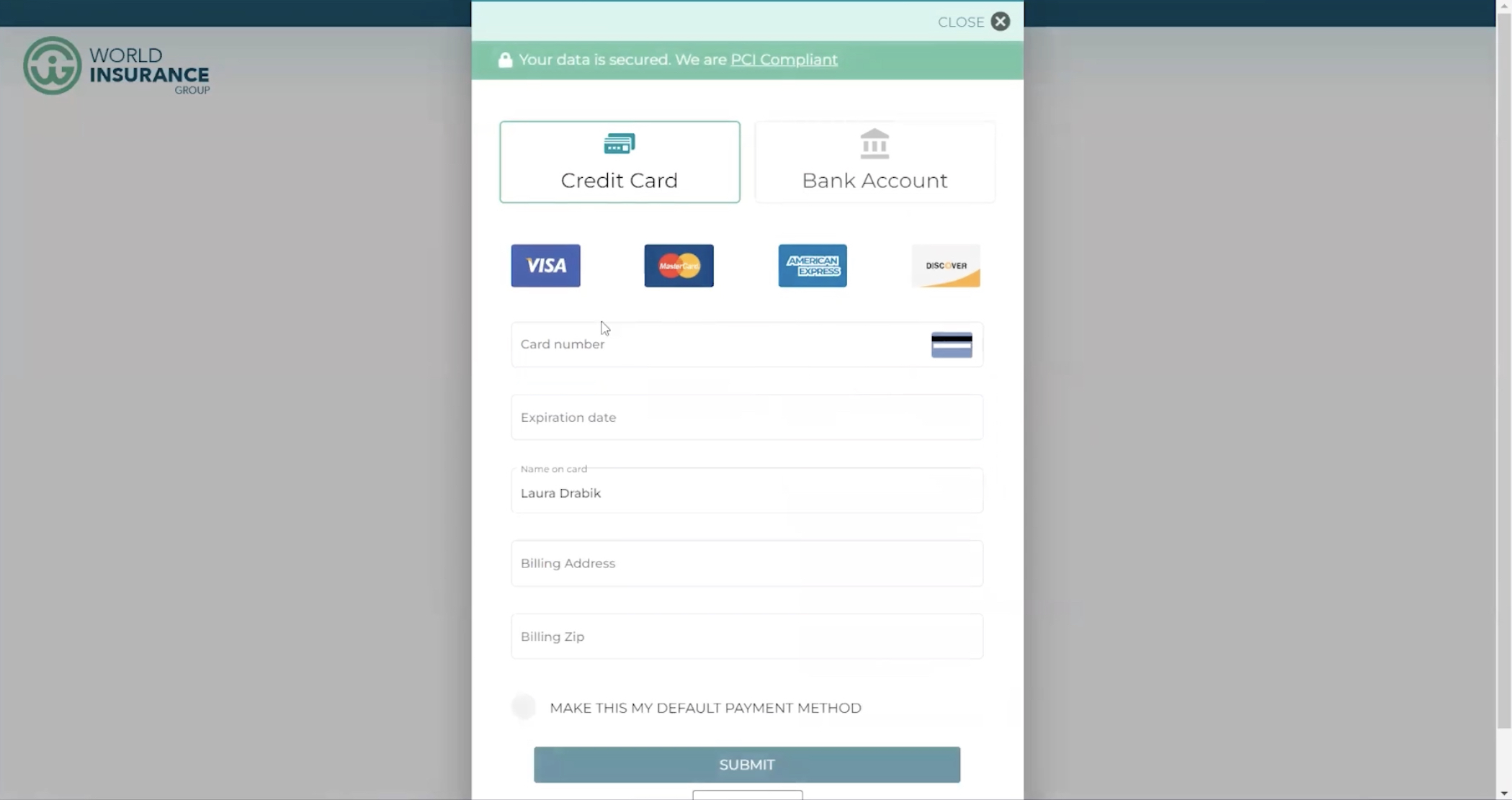

Digital transaction capabilities must include flexible forms of inbound premium payments. This includes down payments as well as installment-, recurring-, and refund-based payments across ACH, CNP, digital wallets, and other payment mechanisms.

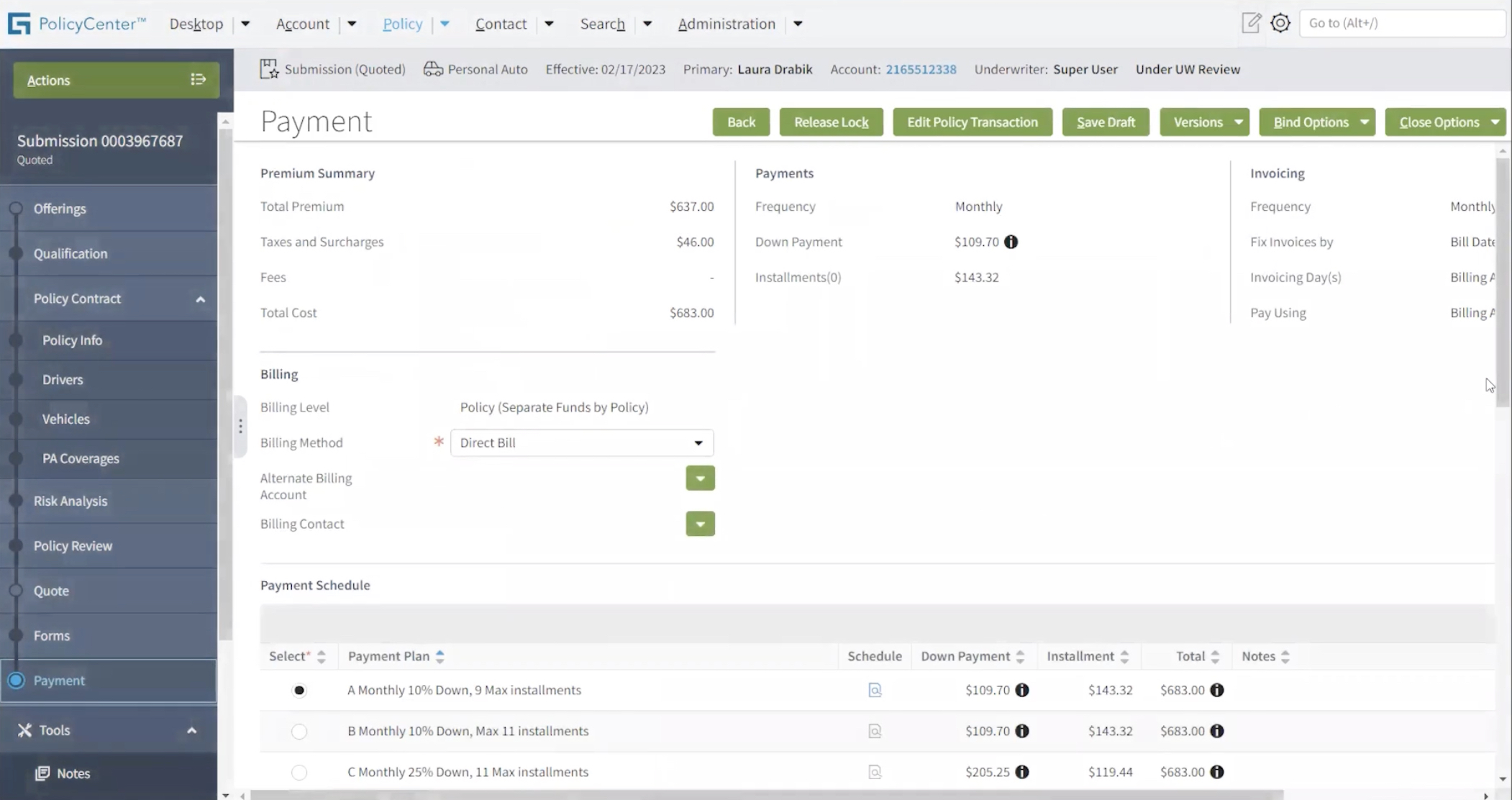

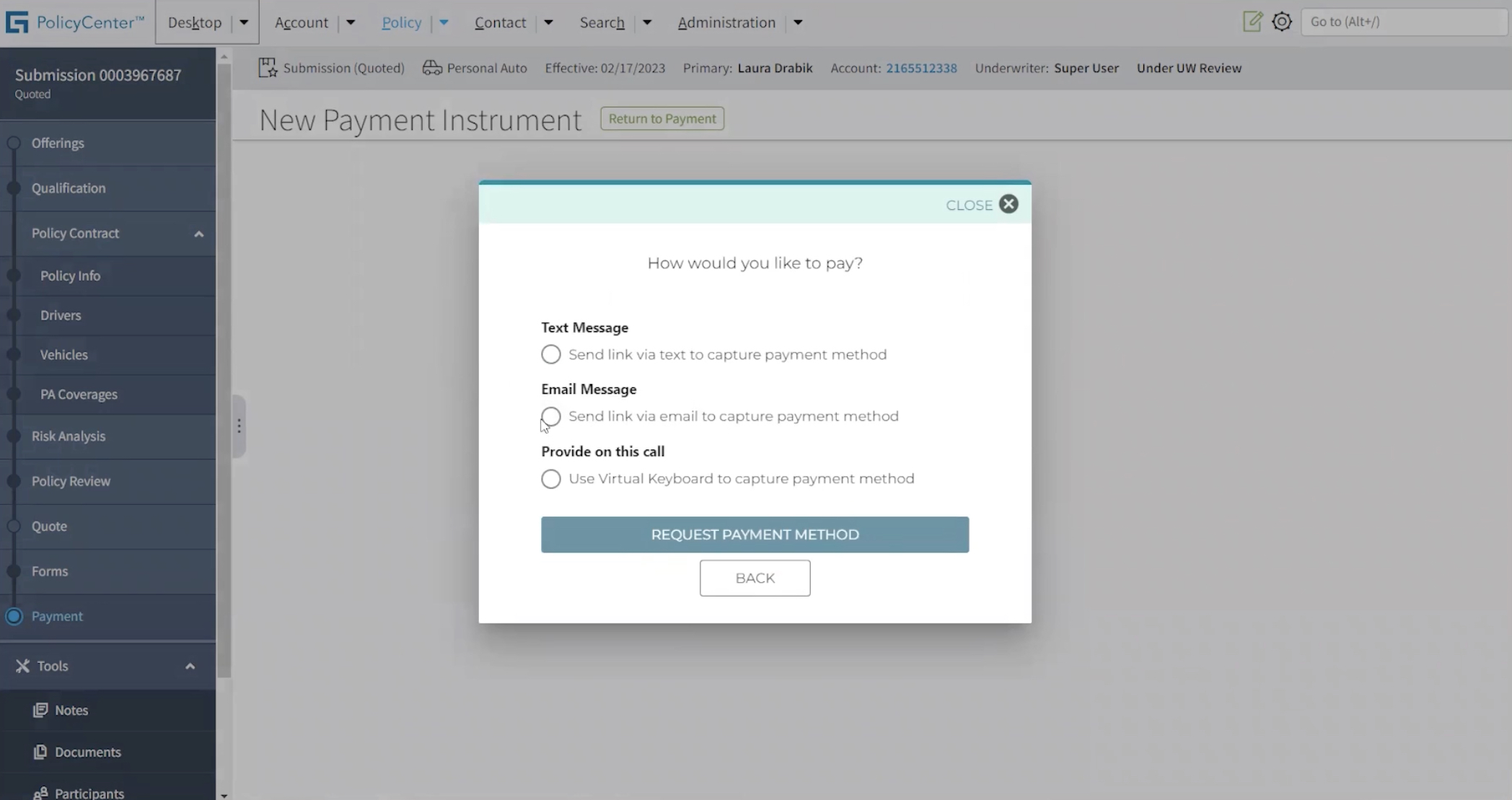

With the Guidewire Digital Payments Solution, for instance, One Inc., is integrated with PolicyCenter to enable agents to seamlessly capture payment plan information …

… along with payment details while speaking with the applicant or via text or email message during policy submission, and then save this information to a secure digital wallet.

Meanwhile, BillingCenter integrates with One, Inc., to process premium refunds, along with seamless options for collecting premium payments—including pay-by-link or virtual terminal—thereby expanding PCI-compliant payment optionality.

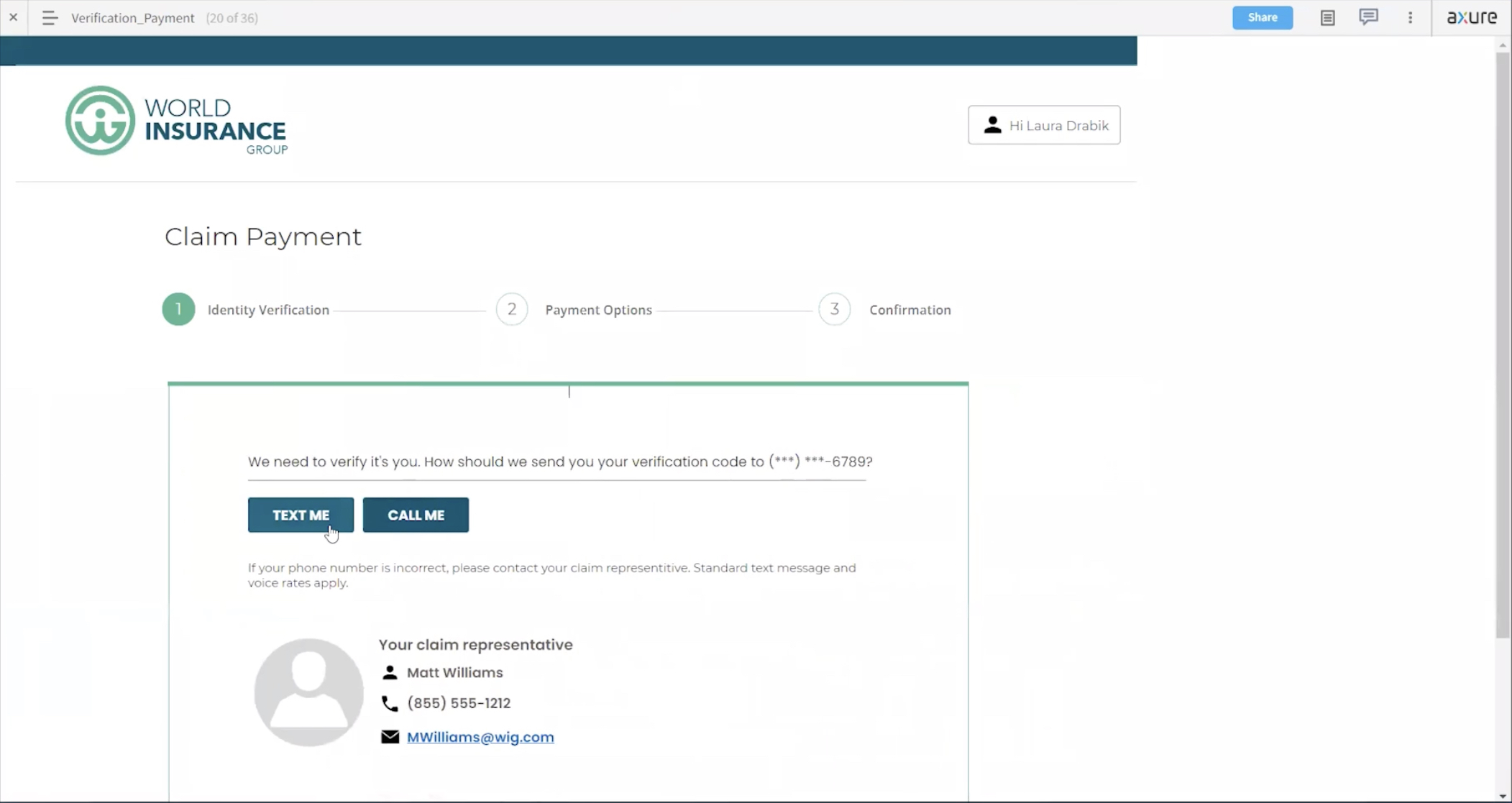

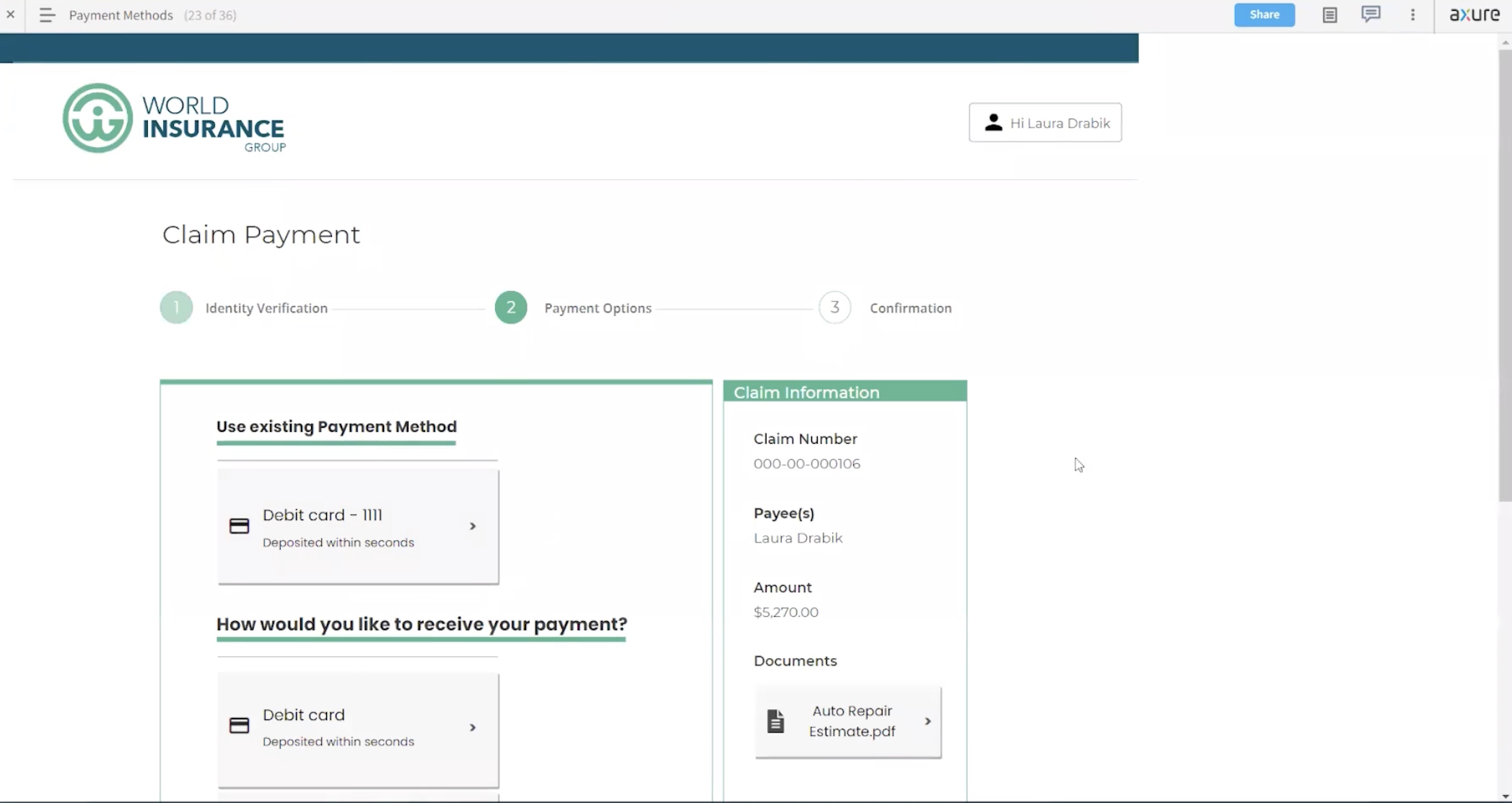

ClaimCenter also integrates with One, Inc., allowing adjusters to initiate identity verification for the claimant …

… and facilitate a real-time claims disbursement either digitally, through ACH, push-to-debit, peer-to-peer via Venmo or PayPal, or through a paper check if the claimant so chooses. These payment capabilities extend to lienholder, mortgagee, and vendor payments as well.

Prioritize enterprise-class delivery and availability.

The ability to support fast, predictable payments is important, but so is system availability. Consumers will quickly abandon transactions after even just 10 seconds of unnecessary friction, and quickly grow frustrated during outages.

That’s even more true when it comes to claims payments. Outages during a large-scale claims event can cause reputational and financial damage to the carrier. Insurers should source options with high levels of performance, backed by a cost-effective annual services agreement.

With the right solutions in place, insurers can see immediate return on investment. Real-world deployments of the Guidewire Digital Payments Solution developed by Guidewire and One, Inc., for example, have helped insurers reduce operational processing expenses by as much as 70%.

Just as we pioneered the industry-leading digital insurance platform, we now have the digital payments technology to help insurers quickly and cost-effectively launch digital payments. We don’t just embrace the digital payments revolution in P&C insurance. We’re leading it.