The global revenue for geospatial analytics will reach $165.99 billion by 2028.

Geospatial data is data about objects, events or phenomena that have a location on the surface of the earth. Geospatial analytics providers gather geospatial data and imagery from sources like satellite and manned aerial. They analyze, manipulate, and display the data collected in a consumable fashion useful for insurers. Providers leverage computer vision and AI to extract structured data such as roof and property conditions. When integrated to Guidewire, solution partners like Betterview provide insurers with improved visibility into their risks helping them to more accurately price, underwrite and adjudicate commercial and personal lines risks.

Who?

Betterview’s machine learning platform provides insurers with actionable insight from aerial and satellite imagery to help them more thoroughly understand their risks. With access to better data throughout the property insurance lifecycle, carriers can better assess damage, mitigate risk, and make better decisions. A better view of risks.

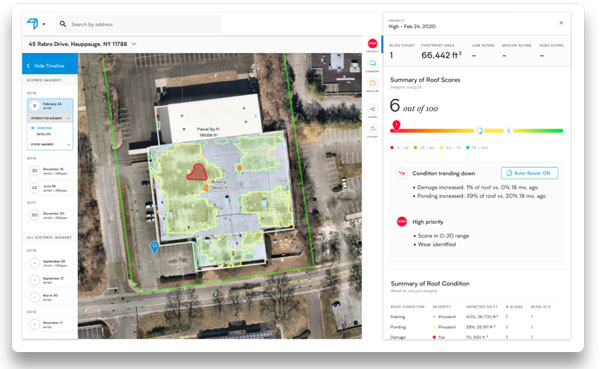

Example of a Betterview Risk Profile

What is the value proposition?

Leveraging computer vision and human analysis of attributes and dimensions in manned aerial and satellite geoimagery, Betterview provides insurers with property data insight into their risks including condition of the property, physical characteristics of the property – think pools and fences, as well as building measurements, permits filed, etc.

Betterview sources their imagery from multiple providers to maintain its quality and “freshness” but they also retain historical images going as far back as 2014 for manned aerial and 2000 for satellite. Current and historical data are both important for thoroughly understanding a risk.

Betterview scores properties based on their predicted probability of loss over time. Based on a score, carriers are empowered to act through the adjusting of pricing and deductibles, endorsements, non-renewals, and conversations with the insured or agent. When integrated to Guidewire, we can route files into the appropriate high-touch or no-touch underwriting workflow based on the score.

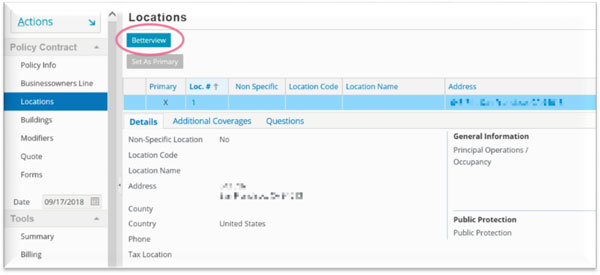

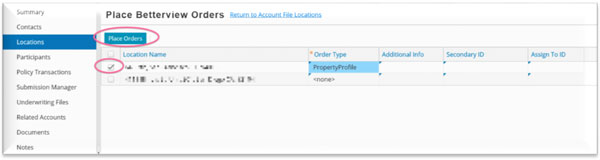

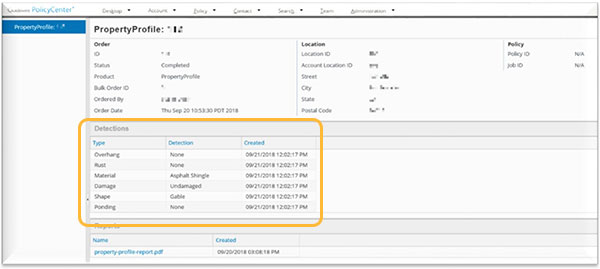

Without having to leave the comfort and convenience of PolicyCenter, underwriters can order reports directly within the policy file. To improve efficiencies, carriers can also automate the ordering of reports within PolicyCenter.

Underwriters leverage the information received from Betterview to make underwriting decisions on whether to insure a risk and at what price. They can also make recommendations to the insured, like updating a roof as a condition for policy issuance.

What is the opportunity?

Geospatial analytics benefits both the insurer and the policyholder. More transparency and visibility into a risk allows the insurer to price the risk more accurately and suggest property improvements to mitigate losses. This helps keep insurance affordable.

Betterview has over 20 customers in production and 5 common customers with Guidewire, including EMC.

As the COVID-19 crisis emerged, a large insurer protected its employees by eliminating onsite inspections. They leveraged Betterview to evaluate property remotely. In just 2-weeks, the insurer and Betterview onboarded over 400 users. Thanks to Betterview profiles, this insurer reported that underwriters were intuitively writing less risky business because, for the first time they had a clear overhead view of the property being underwritten.

Betterview has 100% coverage in the U.S.

Our very own Brian Desmond serves on their board of directors.

Want more detail?

Listen to this short podcast with Co-founder and COO, David Tobias.

Subscribe to InsurTalk wherever you listen to your podcasts:

Enjoy, Laura Drabik