80% of consumers say initiating claims through image-based mobile apps has a positive impact on the customer experience, while nearly 30% say sending an adjuster hurts it.*

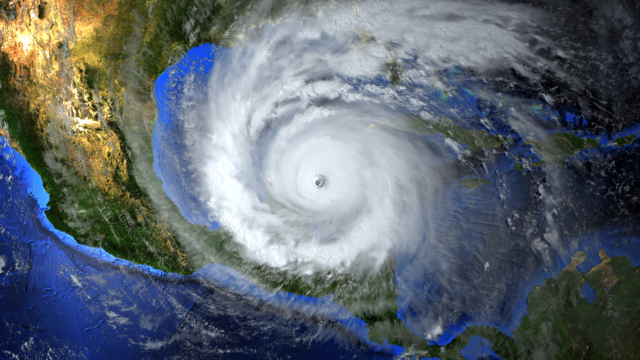

Maybe it’s the COVID Effect or just Amazon-induced impatience. After two years of distancing and a seismic shift in digital adoption rates, consumer expectations for speed and convenience have hit the stratosphere. At the same time, the cost and risk associated with sending adjusters to conduct physical inspections for homeowner claims continue to rise—especially in the wake of large-scale weather-related disasters like Hurricane IDA and widespread flooding in Europe. For customers, claims are the ultimate moment of truth. Those who are pleased with the claims process are 80% more likely to renew their policies—contributing to as much as 30% higher profitability. Those who aren’t may be as much as 41% more likely to take their business elsewhere. According to JD Powers’ 2021 US Property Claims Satisfaction Survey, insurers offering virtual claims reporting over the past year have seen the highest overall satisfaction scores ever measured in the study’s 14-year-history. When integrated with Guidewire, solutions partners like PLNAR help insurers deliver the modern claims experience consumers have come to expect.

Who?

PLNAR is transforming virtual claims management with contactless inspection technology that leverages AI and augmented reality to generate fully measured 3D digital models of property interiors from smartphone pictures uploaded by the homeowner. PLNAR places the adjuster virtually into the space, enabling them to see the damage in full context, as if they’re standing in the room.

What is the value proposition?

Over the past year, the volume of appraisals generated this way has grown nearly 50%, contributing to sky-high satisfaction ratings for insurers who offer them. Thanks to its use of AI, computer vision, and AR, PLNAR streamlines the entire experience by collecting faster and more reliable data and images—enabling touchless inspections and adjusting for interior claims that would otherwise require physical inspection. The result: Lower costs, reduced cycle times, and a customer experience that exceeds expectations.

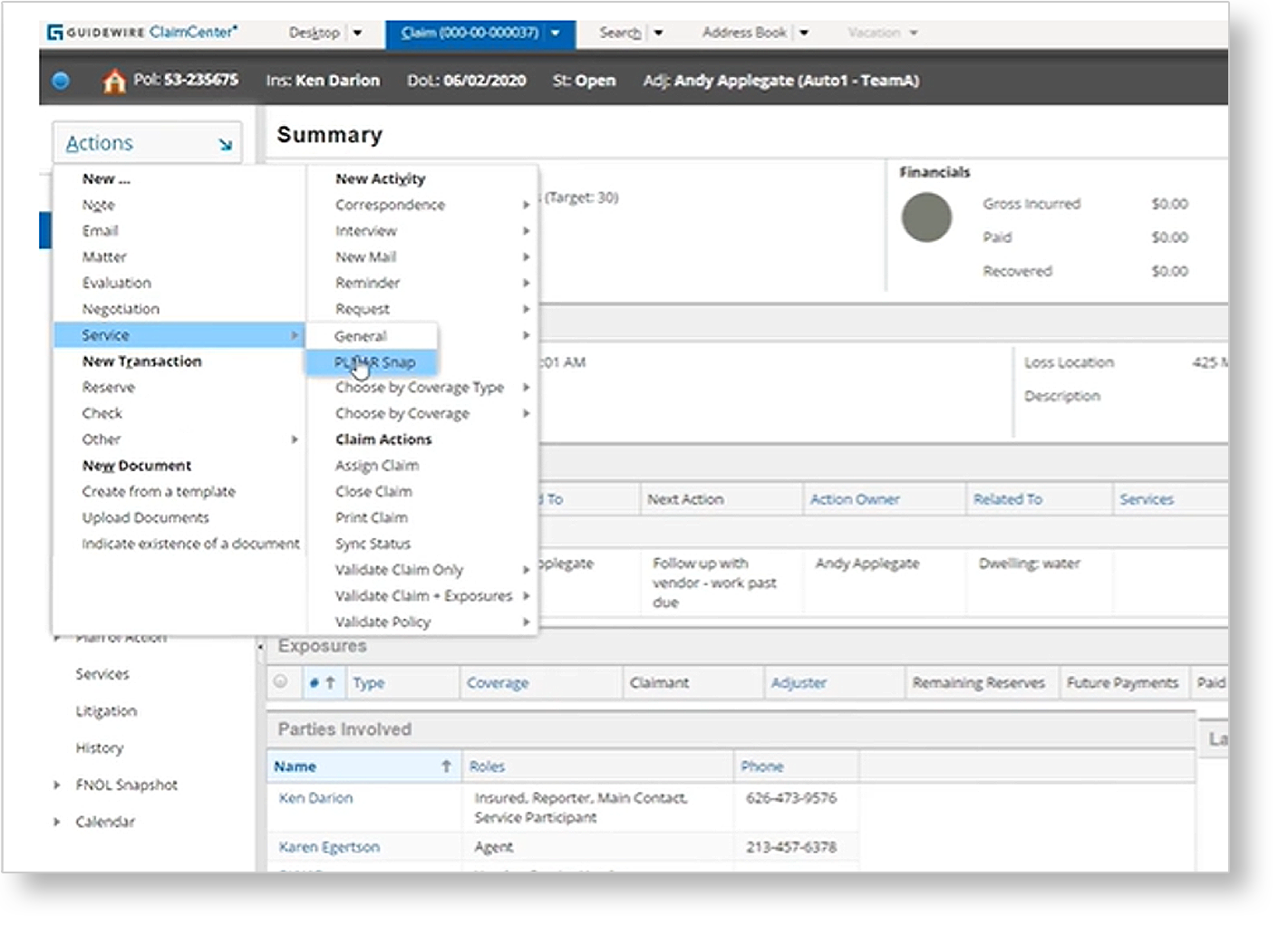

Using the PLNAR Snap™ smartphone app, policyholders can report damages and settle claims quickly by simply taking pictures of the damage and then uploading the images into the PLNAR platform. And the PLNAR add-on for ClaimCenter enables insurers to give adjusters instant access to virtual claims submissions and the ability to leverage measurable digital photos, 3D models, and digital adjusting tools to accelerate cycle times with virtual inspections at scale.

Today, insurers use a variety of resources to document claims, including adjusters, inspectors, gig workers, or the policyholders themselves. But this can result in inconsistent photos, missing data, and other discrepancies—especially after hours or when volumes are high due to a natural disaster or other large-scale event. With AI-enabled virtual inspections, claimants get the help they need, when and where they need it.

Using the PLNAR add-on for ClaimCenter, claims professionals can send a PLNAR SNAP project link to adjusters, gig workers, inspectors, or policyholders direct from ClaimCenter. Which means policyholders preferring a self-service claims experience can get started immediately by downloading the app. No need to schedule appointments or wait for inspectors.

The in-app guide ensures anyone can quickly and easily capture precise, measurable photos of interior spaces and damage—no training required.

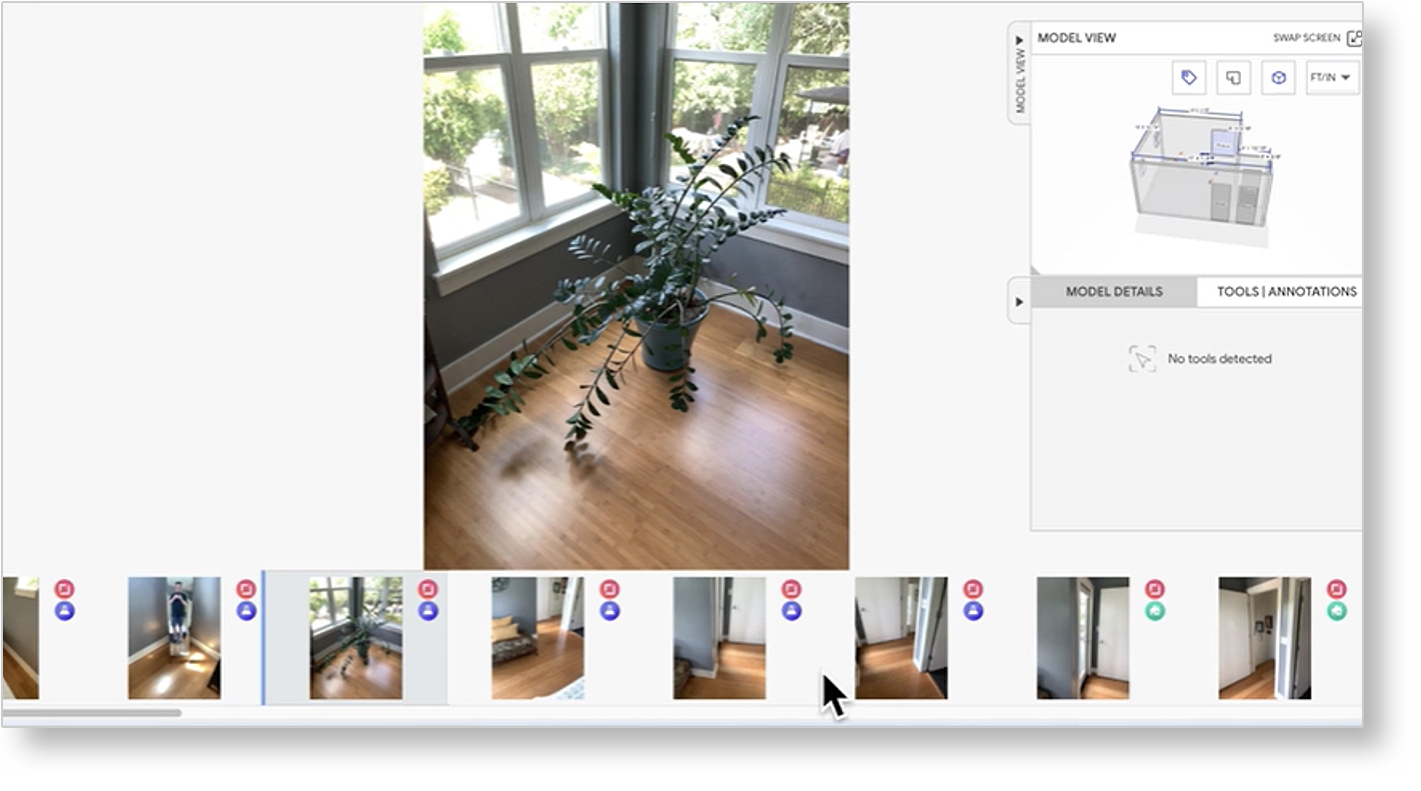

An easy, intuitive interface guides users step-by-step through the process of capturing and submitting photos of interior spaces and damage. They can even add voice or text annotations for additional context. Every photo taken with PLNAR SNAP is embedded with dimensioning metadata that is used to generate interactive, 3D models of the interior space and damage.

Integrated to ClaimCenter, PLNAR supports a 100% virtual claims adjustment process with standardized photo capture and documentation.

The adjuster sets up the PLNAR inspection in ClaimCenter via a seamless integration. There’s no back-and-forth between multiple systems. This can also be done automatically by ClaimCenter, no manual actions required.

Once the images are submitted via the PLNAR app, adjusters instantly gain access to the photos, project details, interactive 2D and 3D models, and virtual adjustment tools directly within ClaimCenter.

Once the images are submitted via the PLNAR app, adjusters instantly gain access to the photos, project details, interactive 2D and 3D models, and virtual adjustment tools directly within ClaimCenter.

From there, they then place themselves directly into the space virtually, add annotations, take additional measurements, generate reports, and use digital adjusting tools to estimate and settle claims 100% virtually.

What is the opportunity?

Just as with so many other digital trends, the COVID-19 pandemic and a record number of large-scale weather-related catastrophes have made virtual inspections a top priority for insurers. Now more than ever, consumers want a fast, friction-free claims experience—especially in their moment of need.

When integrated with ClaimCenter, PLNAR’s AI and augmented realty integration enables insurers to:

- Slash cycle times down from days to mere minutes while lowering costs

- Support 100% virtual inspections—even without Internet or cell signal

- Standardize photo capture and documentation with consistent, accurate data

- Deliver the seamless, self-service claims experience consumers demand

According to the company, PLNAR has helped some insurers reduce cycle times by as much as 75% and reduce loss adjuster expenses by 50% while boosting net promoter scores by 10%. Given customer expectations these days, results like that are virtually amazing.

*Capgemini, The Future of Claims: Digital. Touchless. Seamless.

Want more details?

Watch this video for a demonstration of how Guidewire integrated with PLNAR enables touchless inspections for interior property claims.